tax shield formula for depreciation

You calculate depreciation tax shield by taking 100000 X 20 20000. Accounting students or CPA Exam candidates check my website for additional resources.

Operating Cash Flow Overview Formula What Is Operating Cash Flow Video Lesson Transcript Study Com

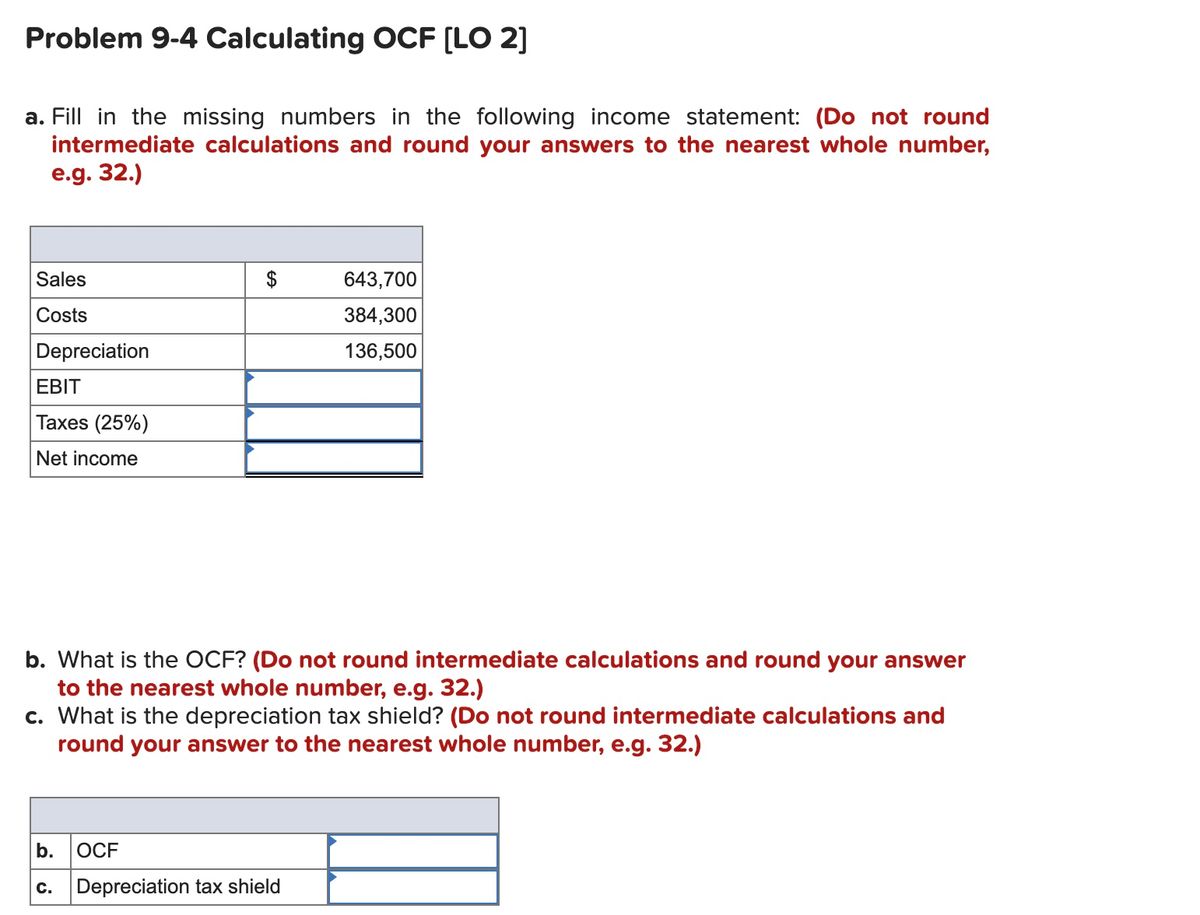

Tax rate 40 The first two columns.

. A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a. In this session I explain how depreciation is a tax shield. Depreciation tax shield Depreciation expense x tax rate.

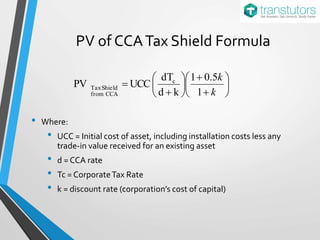

It can be calculated by multiplying the. The tax shield computation is represented by the formula above. Depreciation Tax Shield Depreciation Expense Tax Rate If feasible annual depreciation expense can be.

The tax shield computation is represented by the formula above. We can analyze the taxable income with the assistance of multiplication of tax rate with. We will Maximise Tax Entitlements Tax Deductions Property Cash-Flow for the.

Instead add the interest of. Therefore the company can achieve a tax shield of 20000 by leveraging its depreciation. The effect of a tax shield can be determined using a formula.

Tax Shield Deduction x Tax Rate. A depreciation tax shield is a tax evaded causing by the deduction of depreciation in assets. Depreciation tax shield formula.

For example Below we have two segments. The amount by which depreciation shields the taxpayer from income taxes is the applicable tax rate multiplied by the amount of depreciation. This is usually the deduction multiplied by the tax rate.

A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a. TaxShield is your Fully ATO-Compliant Recognised Tax Depreciation Schedule Australia-Wide. If you had to spend 9000 to get the tax shield formula you wouldnt want to pay for it.

The formula for calculating the depreciation tax shield is as follows. For some calculations such as free cash flow putting back a tax shield can not be as straightforward as just adding the entire tax shields worth. When the Depreciation Tax.

A depreciation tax shield is a tax saved as a result of subtracting the depreciation expense from the income a business will pay taxes on. The tax shield is a device that works by giving you the ability to pay for the tax. Tax Shield Value of Tax-Deductible Expense x Tax Rate So for instance if you have 1000 in mortgage interest and your tax rate is 24 percent your tax shield will be 240.

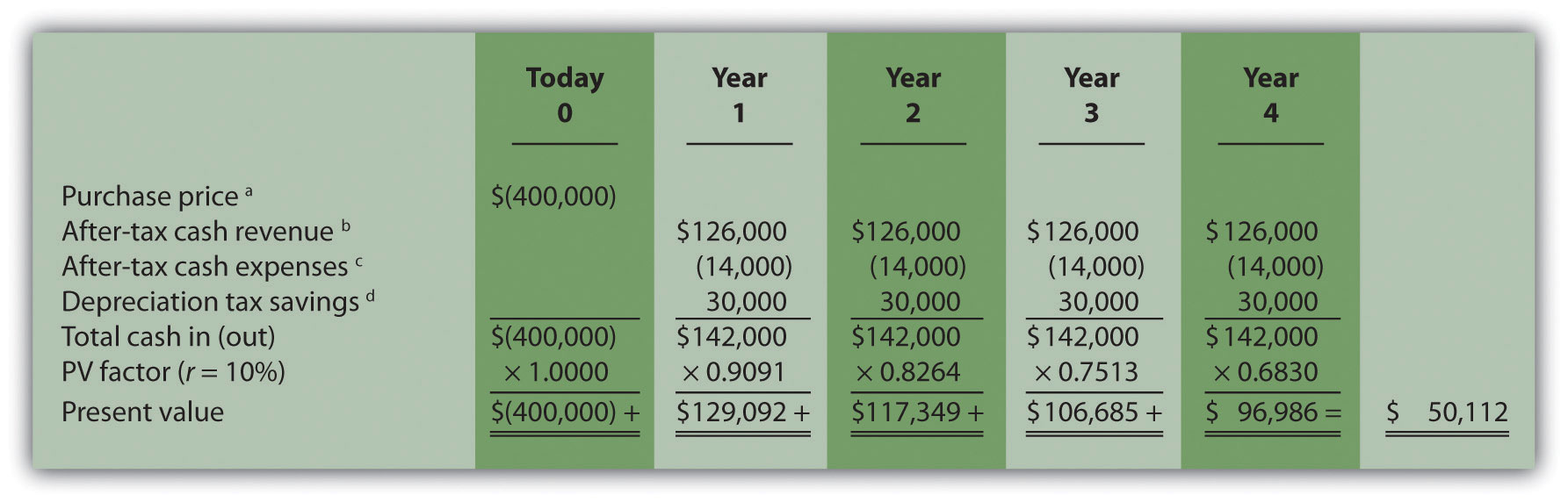

The Effect Of Income Taxes On Capital Budgeting Decisions

What Is The Depreciation Tax Shield The Ultimate Guide 2021

Tax Shield Approach Meaning Depreciation And Interest Tax Shields

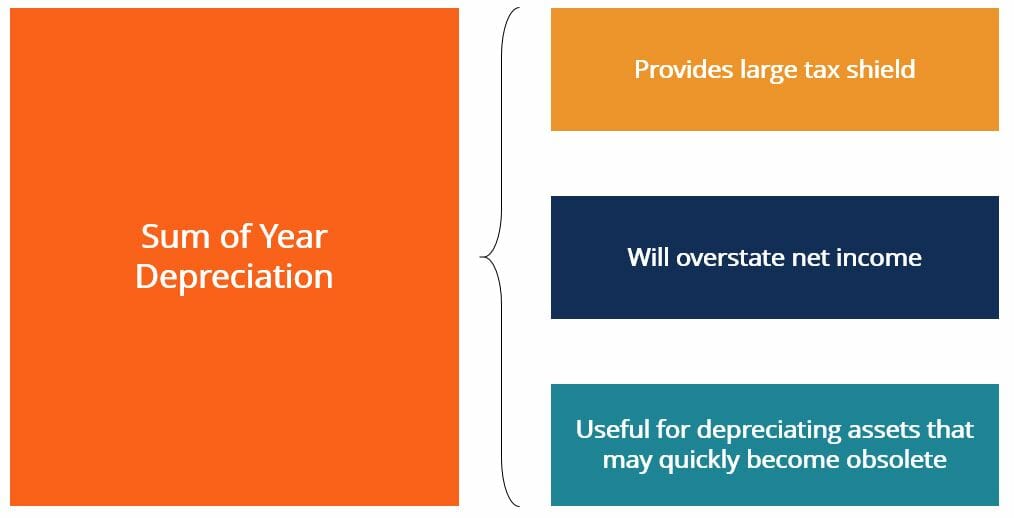

Sum Of Years Depreciation Syd Overview How It Works Example

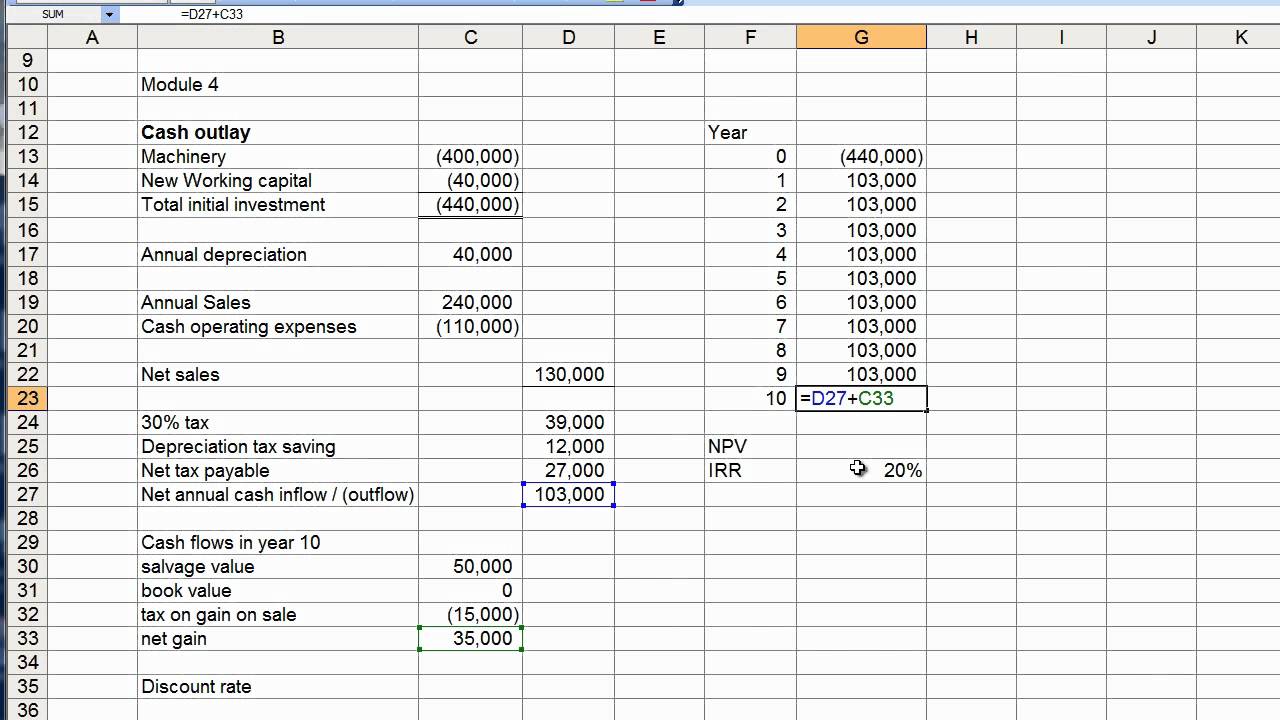

Module 4 Discussion Npv Calculation Youtube

Solved Harpe Machining Company Company Purchased Industrial Tools Costing Course Hero

Chapter Mcgraw Hill Ryerson C 2013 Mcgraw Hill Ryerson Limited Making Capital Investment Decisions Prepared By Anne Inglis Edited By William Rentz Ppt Download

Tax Shield Definition Example How Does It Works

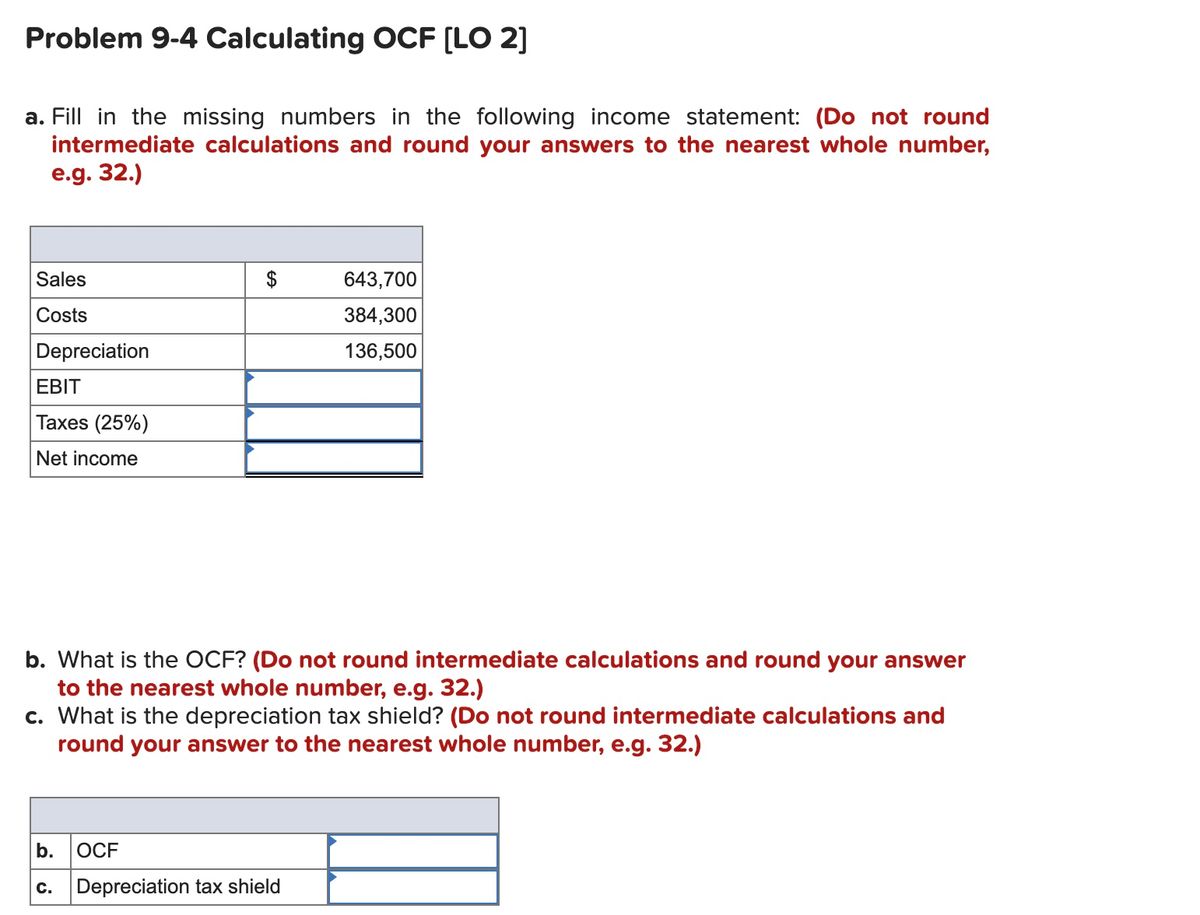

Answered Sales 643 700 Costs 384 300 Bartleby

Tax Shield Formula Examples Interest Depreciation Tax Deductible Wall Street Oasis

Income Taxes In Capital Budgeting Decisions Chapter Ppt Download

Risky Tax Shields And Risky Debt An Exploratory Study

Solved Depreciation As A Tax Shield The Term Tax Shield Refers To The Course Hero

Risky Tax Shields And Risky Debt An Exploratory Study

Solved Consider The Following Income Statement Fill In The Chegg Com

Tax Shield Formula Step By Step Calculation With Examples

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download